hankyoreh

Links to other country sites 다른 나라 사이트 링크

- All

- National

- North Korea

- International

- Eco-Business

- Culture

- Editorial-Opinion

-

The Jeju

April 3rd Incident

Slowing demand for EVs cool investments in Korea’s auto, battery sectors

Posted on : Oct.31,2023 17:12 KST Modified on : Oct.31,2023 17:12 KST

Some analysts attribute the slowdown to high interest rates, but some say this will only be temporary

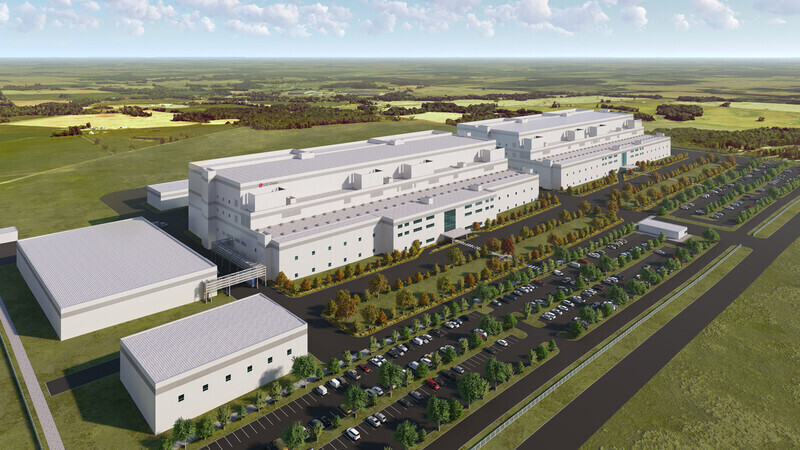

An aerial rendering of LG Chem’s new cathode plant to be built in Tennessee, US. (courtesy of LG Chem)

Editorial・opinion

![[Column] A year and a half of Yoon’s foreign, security policies has added to Korea risk [Column] A year and a half of Yoon’s foreign, security policies has added to Korea risk](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2023/1226/1517035766989839.jpg) [Column] A year and a half of Yoon’s foreign, security policies has added to Korea risk

[Column] A year and a half of Yoon’s foreign, security policies has added to Korea risk![[Column] Korea’s diaspora discrimination [Column] Korea’s diaspora discrimination](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2023/1225/3417034701814775.jpg) [Column] Korea’s diaspora discrimination

[Column] Korea’s diaspora discrimination- [Column] Climate hypocrisy by rich nations

- [Editorial] Korea’s Supreme Court once again rules Japanese firms must directly compensate forced labor victims

- [Editorial] With right-hand man as interim PPP leader, Yoon to solidify grip on party

- [Editorial] Pope’s OK’ing of blessings for same-sex couples should be wake-up call for Korea

- [Column] China’s insistence on “bright prospects” is stifling its economy

- [Column] Chun Doo-hwan and Roh Tae-woo, Yoon Suk-yeol and Han Dong-hoon

- [Column] Yoon’s oblivious diplomacy ended in expo rout – will it also fail to respond to N. Korea’s nukes?

- [Column] Yoon’s war on Korea’s free press earns him headlines in global news outlets

Most viewed articles

- 1Korea’s top constitutional expert predicts Yoon will be dismissed from office

- 2[Column] Giving Yoon the benefit of the doubt

- 3Korea’s steel industry could buckle under Trump’s tariff war

- 4Human rights watchdog draws criticism for recommending guarantees for Yoon’s right to defense

- 5‘Deeply mortified’: Moon apologizes to Koreans for enabling Yoon’s rise

- 6[Editorial] Choi’s ulterior motives for Seoul police chief appointment

- 7[Interview] South Korea’s Moon Jae-in has his regrets

- 8[Column] Trump may have won, but Yoon will lose

- 9[Editorial] Yoon’s prison politicking sounds a lot like a call to defy court

- 10How China used Korean pop culture for ‘cultural security,’ both before and after banning it